Maternal Health Market Reach US $ 32.92 Bn by 2032, Driven by Rising Pregnancy-Related Complications and Integrated Care Models

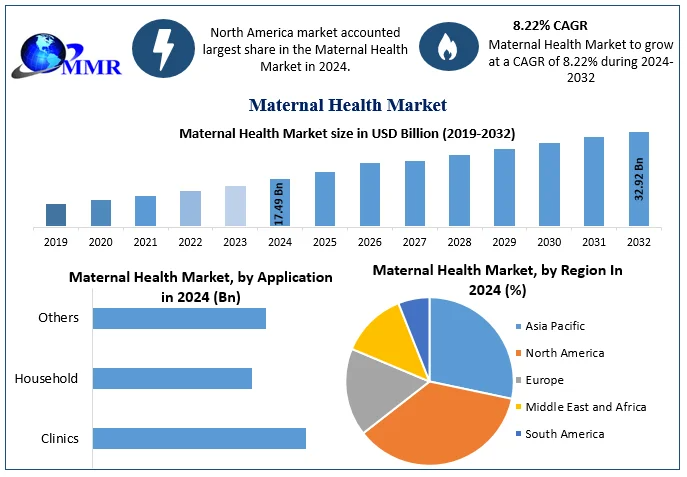

The Maternal Health Market, pegged at US $ 17.49 billion in 2024, is forecast to nearly double—to US $ 32.92 billion by 2032—registering a compound annual growth rate (CAGR) of 8.22% from 2025 to 2032. This acceleration is spurred by escalating incidences of gestational diabetes, hypertension, preterm births, and increasing global efforts to improve prenatal and postnatal care.

Market Growth Drivers & Opportunity

-

Rising Prevalence of Pregnancy Complications

With global upticks in maternal complications—such as gestational diabetes, hypertensive disorders, and preeclampsia—there is surging demand for advanced diagnostic tools, monitoring equipment, and therapeutic solutions throughout pregnancy . -

Integrated Maternal Care Models

Healthcare systems are increasingly adopting collaborative maternal care strategies, uniting obstetricians, midwives, mental health professionals, nutritionists, and pediatricians. This holistic approach improves continuity of care and fuels market growth . -

Government Initiatives & Rising Awareness

Programs like “Healthy China 2030” and campaigns by WHO and NGOs push for better maternal outcomes, enabling infrastructure expansion, wider maternal health service coverage, and increased product adoption . -

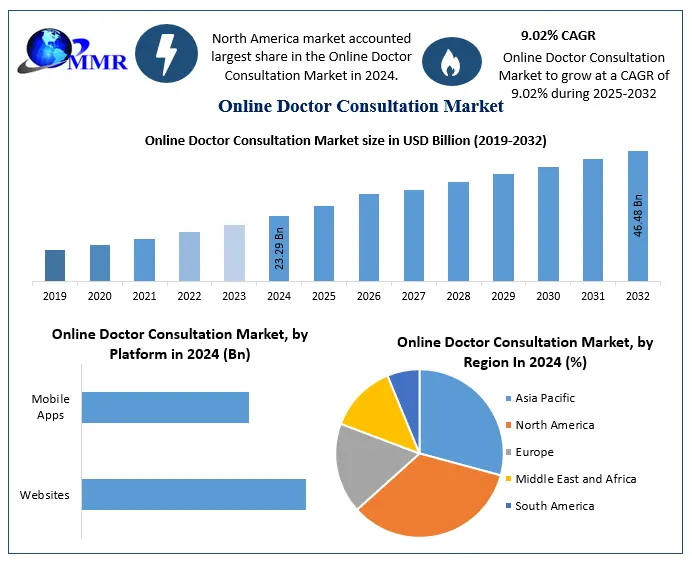

Technological Innovation & Telehealth

Digital interventions—such as remote fetal monitoring, teleconsultations, and AI-based risk prediction—are making maternal care accessible even in remote areas, creating untapped markets . -

Increasing Disposable Incomes in Emerging Economies

Countries with improved economic statuses are showing a clear preference for premium prenatal vitamins, diagnostics, and at-home care, especially in the clinical and domestic care segments .

Market Opportunity:

Millions of births annually in developing nations represent enormous opportunity. As APAC leads growth, private facilities and telehealth services can capture unmet demand. Innovations in maternal nutrition, mental health support, and point-of-care diagnostics promise compelling investment avenues.

Segmentation Analysis

According to Maximize Market Research, the market is classified by:

1. Type of Pregnancy

The report covers intrauterine, ectopic, tubal, and other pregnancies. Notably, the rising incidence of ectopic pregnancies is expected to influence treatment protocol development and demand .

2. Risks in Pregnancy

Pregnancies are categorized into high-risk and molar pregnancies. High-risk cases—such as those involving gestational diabetes or hypertension—generate demand for specialized monitoring and interventions.

3. Complications

Sub-segments include miscarriage, premature labour and birth, and other complications, each necessitating targeted care solutions.

4. Delivery Type

The segmentation further includes vaginal delivery, cesarean section, and others, reflecting the varying needs during childbirth—such as anesthetics, surgical tools, and recovery services.

5. By Application

Final segmentation is by application: Hospitals, Clinics, Household (homecare products), and Others. Hospitals dominate (~52% share in 2024) due to high birth volumes, while clinics, buoyed by rising disposable income, are slated to gain significant share .

Get a Sample PDF Brochure: https://www.maximizemarketresearch.com/request-sample/189366/

Country‑Level Analysis

The maternal health market’s dynamics differ across countries based on healthcare policies, infrastructure, and socioeconomic factors:

United States

A mature market with high insurance coverage, advanced ICU and NICU facilities, and rising maternal mortality disparity initiatives. Hospitals and clinics heavily invest in advanced maternal diagnostics and care.

Germany

A mix of public-private healthcare with comprehensive prenatal and postnatal coverage. Regulatory compliance under EU IVDR encourages adoption of standardized monitoring and diagnostic devices.

China

Under the “Healthy China 2030” mission, China is expanding maternal health infrastructure. Increased insurance inclusion for prenatal diagnostics and rising chronic maternal conditions are fueling demand.

Japan

Boasts high maternal healthcare standards; investments are focused on mental health support, fertility management, and genetic screening services to address ageing mothers.

India

Despite infrastructure disparities, government initiatives like Janani Suraksha Yojana and significant NGO involvement are improving maternal care access. The large rural population makes telehealth and affordability essential.

Nigeria

One of the highest maternal mortality rates globally. Efforts by WHO and local governments to increase skilled birth attendance, emergency obstetric care, and remote maternal support mark a turning point.

Competitive Landscape & Recent Developments

Key players identified by the report include:

-

Johnson & Johnson Private Limited (USA)

-

Jiovio Healthcare (Singapore)

-

McKinsey & Company (USA)

-

MedTech Boston (Germany)

-

Merck & Co., Inc. (USA)

-

RAND Corporation (USA)

-

SYNAPSE Product Development (USA)

Recent Developments:

-

Johnson & Johnson : Launched novel prenatal supplements and expanded fetal monitoring systems, promoting maternal and neonatal wellness.

-

Merck & Co., Inc. : Introduced specialized therapeutic protocols for managing preeclampsia; enhanced partnerships focusing on gestational diabetes interventions.

-

Siemens Healthineers: Released next-gen ultrasound and remote-monitoring tools streamlining prenatal diagnostics across public and private hospitals.

-

Reckitt Benckiser : Rolled out enhanced maternal hygiene and home care products—such as antiseptic washes and postpartum care essentials—with a focus on emerging markets.

-

Sanofi (India): Launched maternal vaccines and nutrient-fortified formulations to reduce anemia; partnered with government to enhance maternal health outreach in rural regions.

These initiatives reflect a clear strategic shift: strengthening product pipelines for high-risk pregnancies, expanding diagnostic infrastructure, and tapping into emerging market demands.

Conclusion

With a robust forecasted rise from US $ 17.49 Bn (2024) to US $ 32.92 Bn by 2032 at a CAGR of 8.22%, the Global Maternal Health Market is entering a golden era . Growing maternal complications, integrated care models, regulatory backing, and digital innovation are reshaping maternal healthcare worldwide.

Developed economies continue investing in advanced diagnostics and therapeutic care, while emerging markets offer fertile ground for affordable homecare solutions, telehealth, and community outreach. As the top industry players roll out new prenatal supplements, monitoring technologies, and digital platforms, the stage is set for elevated standards, improved outcomes, and transformative growth.

This surge in maternal health is not just a market trend—it marks a pivotal advancement in global public health. With increasing focus on maternal well-being, the coming decade promises a healthier start for mothers and babies alike.