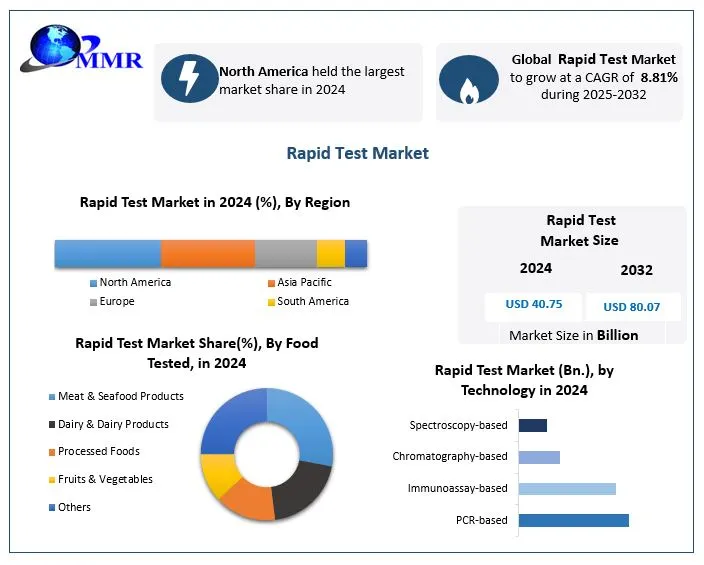

Rapid Test Market Overview :

The Rapid Test Market was valued at USD 40.75 billion in 2024 and is projected to nearly double to USD 80.07 billion by 2032, reflecting a robust CAGR of 8.81% during 2025–2032. Key drivers include high demand for fast, accessible diagnostics, post-pandemic consumer behaviors, rising home testing trends, technological innovation, and the rising burden of infectious and lifestyle-related diseases .

United States – Growth & Consolidation

-

Growth Outlook (US): North America led the market in 2024, with the United States holding the largest share thanks to strong healthcare infrastructure, high public health spending, and streamlined regulatory pathways .

-

Opportunity & Trends: The trend toward self-testing and point-of-care diagnostic accessibility is gaining traction, bolstered by consumer demand for convenience and early detection .

-

Consolidation (M&A):

-

Quidel acquired Ortho Clinical Diagnostics in December 2021 for about USD 6 billion, expanding its COVID-19 antigen and antibody testing portfolio .

-

Sherlock Bio is conducting trials for an over-the-counter rapid STI test (for chlamydia and gonorrhea), aiming for a mid-2025 launch — potentially the first non-prescription home STI rapid test in the US .

-

-

Updation: The FDA continues to adapt regulations to allow more home-based CRISPR-based and multiplex rapid tests, signaling a trend toward more decentralized diagnostic models.

Asia-Pacific – Opportunity & Trends

-

Growth Outlook: Asia-Pacific is the fastest-growing region, projected to grow at a CAGR of 10.72% during 2024–2030 .

-

Opportunity & Trends: Driven by large populations, rising disposable incomes, heightened health awareness, and expanding access to care in developing economies (e.g., India, China, Brazil) .

-

Consolidation (M&A):

-

Qiagen has expanded in the region by opening offices in New Delhi, India, and Taipei, Taiwan, as part of a broader strategy to focus on emerging markets and personalized medicine .

-

-

Updation: Innovations such as AI-enhanced rapid test interpretation (e.g., smartphone-based recognition using CNN/YOLO) are emerging to improve usability and accessibility in the region .

Explore detailed data and insights by viewing the sample @https://www.maximizemarketresearch.com/request-sample/544/

Europe – Trends & Consolidation

-

Trends: The European market emphasizes technological innovation against antimicrobial resistance (AMR). For instance, Sysmex Astrego, a Swedish company, won the £8 million Longitude Prize for a rapid test that identifies urinary tract infections and antibiotics susceptibility in under an hour, already being considered for adoption by the UK’s NHS .

-

Consolidation (M&A):

-

Eurofins Scientific has been active with acquisitions including Orchid Cellmark (UK, August 2024), Infinity Laboratories (Colorado, Sept 2024), and the clinical diagnostics arm of Synlab in Spain (October 2024), significantly expanding its footprint in Europe and beyond .

-

In Italy, DiaSorin acquired Luminex Corporation in July 2021 and the Focus Diagnostics business unit this year, strengthening its molecular diagnostics portfolio .

-

-

Updation: European regulatory frameworks (CE marking, MDR) continue to evolve, encouraging rapid test development while ensuring stringent safety standards.

Middle East & Africa (MEA) – Opportunity & Trends

-

Trends: While specific CAGR data is not cited in the source, MEA is identified as a distinct region with dedicated analysis in the report.

-

Opportunity: Growing demand for rapid diagnostics in underserved areas, combined with efforts to improve healthcare accessibility, presents significant growth potential.

-

Consolidation (M&A): Broader diagnostics sector has seen heavy capital investment — the clinical health testing and diagnostics industry raised USD 69.7 billion across 538 M&A deals — signaling consolidation trends that likely extend into MEA .

-

Updation: International players are increasingly entering MEA through partnerships and localized manufacturing to tap into emerging demand, particularly in OTC and point-of-care testing.

Conclusion

The global Rapid Test Market is undergoing a transformative phase, driven by technological innovations, rising consumer demand for quick and reliable diagnostics, and aggressive consolidation across regions. While the United States continues to dominate through regulatory flexibility and strong healthcare infrastructure, the Asia-Pacific region stands out with the fastest growth rate, fueled by large populations and expanding access to healthcare. Europe remains a hub of innovation and strategic M&A, particularly in addressing antimicrobial resistance, while the Middle East & Africa present untapped opportunities through growing investments in healthcare accessibility. With leading players such as Quidel, Qiagen, Eurofins, and DiaSorin shaping the competitive landscape, the industry is poised for accelerated expansion, making rapid tests a cornerstone of modern healthcare diagnostics worldwide.