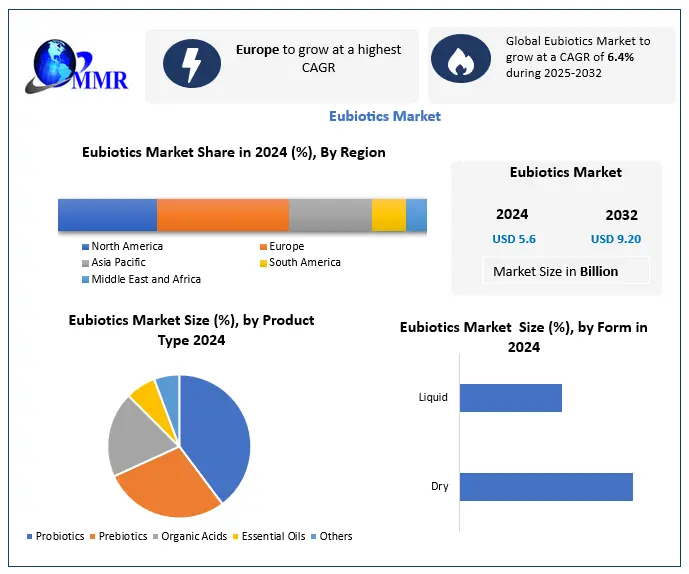

Eubiotics Market Poised for Strong Growth: USD 5.6 Billion in 2024 to USD 9.20 Billion by 2032

The Eubiotics Market was valued at USD 5.6 Billion in 2024 and is projected to reach nearly USD 9.20 Billion by 2032, growing at a CAGR of 6.4% from 2025 to 2032. The growth is being fueled by rising awareness about animal welfare, regulatory restrictions on antibiotic usage, and increasing demand for sustainable livestock nutrition. Higher demand is observed in Europe due to strict regulations and in Asia-Pacific due to the rapid expansion of animal farming industries.

The competitive landscape features leading players such as BASF SE, Cargill Incorporated, DSM N.V., Novus International, ADDCON, and Calpis Co., Ltd., who are investing in R&D, mergers, and capacity expansion to strengthen their global market presence.

United States – Growth & Consolidation

-

Growth: The US market benefits from advanced animal husbandry practices and consumer preference for antibiotic-free animal products.

-

Opportunity: Rising demand for probiotics and organic acids in cattle and poultry feed is boosting adoption.

-

Trends: Increasing penetration of sustainable eubiotics aligned with USDA and FDA guidelines.

-

Consolidation (M&A): Cargill has actively expanded its portfolio through acquisitions such as Diamond V (probiotics company) and collaborations with startups focusing on gut health solutions.

-

Updation: Regulatory pressures, including FDA’s Veterinary Feed Directive, continue to encourage a shift toward natural eubiotics.

Asia-Pacific – Opportunity & Trends

-

Growth: Asia-Pacific is expected to be the fastest-growing region, driven by large livestock populations in China, India, and Southeast Asia.

-

Opportunity: Rising demand for meat and dairy products is propelling growth of natural feed additives.

-

Trends: Adoption of probiotic and prebiotic feed solutions supported by government initiatives for sustainable farming.

-

Consolidation (M&A): DSM N.V. strengthened its footprint in Asia-Pacific by acquiring Erber Group’s Biomin (Austria-based, but strong Asian presence) in 2020.

-

Updation: Use of digital livestock management tools alongside eubiotics is trending in emerging economies.

Explore detailed data and insights by viewing the sample @https://www.maximizemarketresearch.com/request-sample/84503/

Europe – Trends & Consolidation

-

Growth: Europe leads the global market with the largest share, underpinned by EU bans on antibiotic growth promoters.

-

Opportunity: Strong focus on animal health, food safety, and sustainable livestock systems drives innovation.

-

Trends: Growing preference for organic acids and essential oils as eubiotics in swine and poultry nutrition.

-

Consolidation (M&A): BASF SE and ADM have engaged in joint ventures and partnerships across Europe to expand sustainable feed additive solutions.

-

Updation: Ongoing EU regulatory updates under EFSA (European Food Safety Authority) ensure stricter compliance, pushing innovation in natural solutions.

Middle East & Africa – Opportunity & Updation

-

Growth: MEA shows strong potential due to rising investments in modern poultry and dairy farming.

-

Opportunity: Governments are investing in food security programs, driving adoption of eubiotics in livestock nutrition.

-

Trends: Increased use of imported feed additives as well as localized production partnerships.

-

Consolidation (M&A): International players are entering MEA markets through distribution partnerships (e.g., Novus International and local feed producers).

-

Updation: With growing urban populations, MEA is expected to adopt eubiotics for poultry farming at a faster rate over the next decade.

Conclusion

The Global Eubiotics Market is entering a decisive growth phase, fueled by the rising demand for antibiotic-free animal products, sustainable livestock nutrition, and strict regulatory frameworks worldwide. With the market projected to grow from USD 5.6 Billion in 2024 to nearly USD 9.20 Billion by 2032 at a steady CAGR of 6.4%, opportunities are abundant across regions. While Europe continues to lead through regulatory enforcement and innovation, Asia-Pacific emerges as the fastest-growing hub driven by population growth and protein demand. The United States remains a stronghold of consolidation and innovation, while the Middle East & Africa are opening new opportunities through modernization and food security initiatives. With major players like BASF SE, DSM N.V., Cargill Incorporated, and Novus International actively shaping the landscape through mergers, acquisitions, and R&D investments, the eubiotics industry is set to become a cornerstone of the global transition toward sustainable and healthier animal nutrition systems.