Plasma Feed Market Definition & Estimation

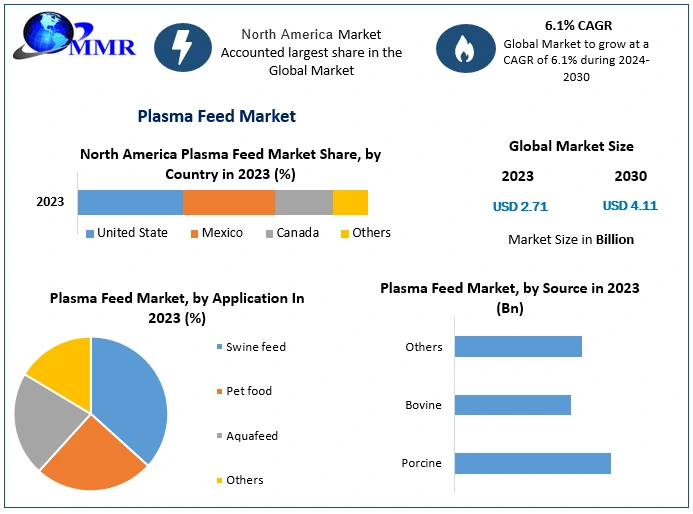

The global Plasma Feed Market, which comprises animal-derived plasma proteins used as high-value protein additives in livestock and pet nutrition, was valued at approximately USD 2.71 billion in 2023. Forecasts indicate it will expand to around USD 4.11 billion by 2030—equivalent to a robust CAGR of 6.1% over 2024–2030 .

Definition: Plasma feed is produced from spray-dried animal blood plasma—rich in protein, immunoglobulins, peptides, and bioactive molecules—offering superior digestibility and natural immune support. It serves as an alternative to antibiotics in swine, poultry, aquaculture, and pet diets.

Market Growth Drivers & Opportunities

1. Rising Demand for Antibiotic-Free Feeds

Global regulatory and public health pressures are phasing out prophylactic antibiotics in animal rearing. Plasma feed, with its bioactive proteins, enables enhanced gut health and immunity—ideal for early-life diets (especially piglets). Reports indicate 55%+ adoption in antibiotic-free feed programs, and up to 45% improvements in feed conversion ratios .

2. Expansion of Livestock and Aquaculture

Increasing meat and seafood consumption demands efficient feed solutions. FAO data shows steady rises in meat (~5% per year) and dairy consumption (~3.5–4%)—with aquaculture growth around 1–1.2% annually . Plasma feed supports these sectors with high-quality protein and immune-enhancing benefits.

3. Pet Food Premiumization

The surge in pet ownership and humanization is increasing demand for premium pet nutrition. Plasma proteins deliver water binding, palatability, and bioactive benefits. In markets like North America and Europe, pet food usage comprises ~20% of plasma feed volume and represents the fastest-growing segment .

4. Technological Advances in Plasma Processing

Innovations in membrane filtration and spray-drying have improved nutrient retention and food safety, fueling manufacturing capacity and scalability .

5. Sustainability and Alternative Protein Trends

The shift toward sustainable and circular bioeconomy solutions positions plasma feed—often derived from slaughterhouse by-products—as a recycler of high-value proteins, appealing to environmentally conscious stakeholders .

6. Expanding in Emerging Markets

Rapid growth in Asia-Pacific and Latin America, driven by rising incomes and livestock production, offers major upside. Asia-Pacific is forecast to remain the fastest-growing region, with China and India illustrating the trend .

Segmentation Analysis

By Source

-

Porcine plasma: Dominant due to high digestibility and immunoglobulin content—critical in swine and poultry feeds.

-

Bovine plasma: Used in ruminant and aquaculture diets, supporting muscle growth and immunity.

-

Other sources: Including sheep, goat, fish plasma—targeting niche applications in specialty feeds .

Commercial status: Porcine leads in market share; bovine is growing steadily, while “other” sources provide tailored applications.

By Application

-

Swine feed: The largest segment, essential for weaning piglets—driving much global demand .

-

Pet food: Fastest-growing, especially in developed and emerging markets, driven by demand for quality pet nutrition .

-

Aquafeed: Third major application—gaining traction as aquaculture expands globally .

-

Others: Include poultry and ruminant feed—successful but smaller niches.

By Region

-

North America: Largest region (~30–40% market share), led by the U.S. and Canada, with strong biotech adoption and farm consolidation .

-

Asia-Pacific: Fastest growth trajectory; Asia-Pacific will dominate by 2028 as livestock and aquaculture industries expand .

-

Europe: Mature market with solid uptake in antibiotic-free and natural feed strategies .

-

Latin America & MEA: Smaller but growing, driven by improving agricultural infrastructure and rising protein demand.

Country-Level Analysis: USA & Germany

USA

Accounting for over 25% of global plasma feed volume, the U.S. market is led by advanced livestock systems, early adoption of spray-dried plasma, and widespread antibiotic-free programs . New processing facilities and partnerships—such as those by Darling Ingredients—are scaling production capacity domestically .

Germany

Europe’s leading market is characterized by its integration in EU animal welfare standards and sustainable farming approaches. German companies like SARIA and Veos are innovating plasma products for both livestock and pet segments, supported by EU regulations that restrict antibiotic growth promoters .

Commutator (Competitive) Analysis

Major Players:

-

Darling Ingredients Inc., Lauridsen Group, Veos Group, SARIA Group, APC Inc., Puretein, Rocky Mountain Biologicals .

Competitive strengths:

-

Scale and integration: Firms like Darling use sustainable by-product streams to produce plasma in-house.

-

Product innovation: APC and Veos are developing hydrolyzed plasma and immobilized functional formulas.

-

Geographic reach: European-based SARIA, Veos, Sera Scandia, German Kraeber supply regional demand; Lauridsen exports globally.

-

Quality & differentiation: Brands emphasize safety, traceability, and supply chain verticals to meet antibiotic-free and clean-label claims.

Emerging competition: New entrants (e.g., Lican Food in Chile, Feedworks in Australia) serve local/regional markets. Consolidation and M&A are expected as larger players build global scale.

Barriers: High capital needs for processing; disease and regulatory constraints on animal-sourced feed; cultural sensitivities in key usage regions.

Market Opportunity & Challenges

Opportunities

-

Antibiotic-free momentum: Preferential use in young livestock programs drives demand.

-

Pet food premiumization: A growing, high-margin niche.

-

Aquaculture expansion: With seafood consumption increasing, high-performance feed solutions are vital.

-

Processing tech improvements: Reduction in cost and increased output enhance margins.

-

Emerging economies: Latin America, Africa are under‑penetrated but showing rising farm productivity needs.

Challenges

-

Animal-source resistance: Cultural opposition in specific markets.

-

Regulatory variability: Differences in acceptance (especially bovine plasma use).

-

Pathogen risk: Disease in livestock can disrupt plasma supply.

-

Alternative proteins: Vegetable proteins and synthetic peptides compete for feed share.

Conclusion

The global plasma feed market stands poised for sustained growth—rebasing from USD 2.71 billion in 2023 to approximately USD 4.11 billion by 2030, with CAGR trends between 5–6% through the early 2030s . Key dynamics include:

-

Uptrend in antibiotic-free and sustainable feed solutions.

-

Technology-driven efficiency from spray-drying and filtration.

-

Regional tilt: North America leads, Asia-Pacific grows fastest, Europe stays strategic.

-

Competitive landscape: large global players fueled by integration and innovation; new players finding niche segments.

Looking ahead, plasma feed is likely to maintain its position as a core segment of animal and pet nutrition. The future will be shaped by regulatory frameworks, tech innovation, sustainable practices, and evolving dietary trends. Market entrants and incumbents alike must invest in high-precision processing, disease-safe sourcing, and region-specific market penetration to capitalize on global demand for nutritious, environmentally conscious feed.

Related Post :

Genomics Market